French Public Investment Bank Bpifrance Eyes Increased Export Financing for Defense Firms

PARIS – In a bid to bolster France’s defense sector competitiveness on the global stage, the public investment bank Bpifrance is advocating for an increase in its export financing limits for small and medium-sized defense firms. Currently, Bpifrance provides up to €25 million (approximately US$27 million) for export deals, a figure that Bpifrance’s head of export finance, Hugues Latourrette, aims to elevate to roughly €40 million by 2025.

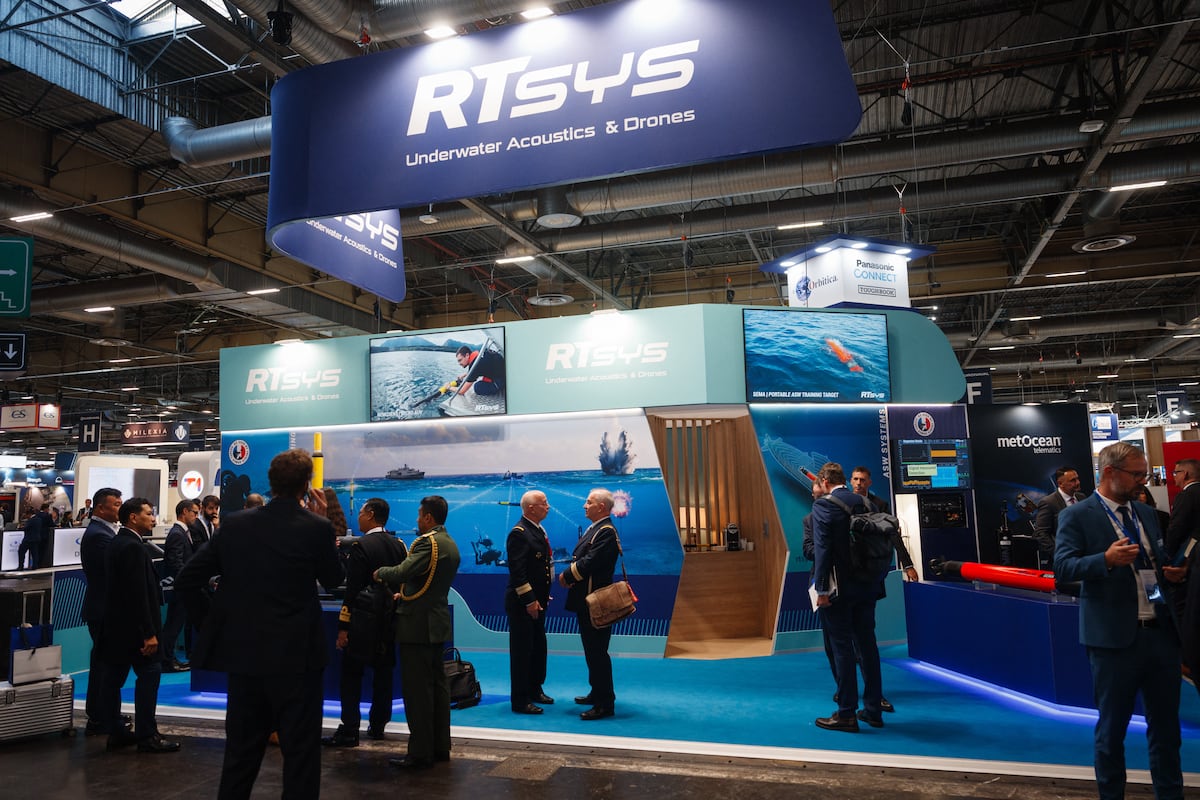

Speaking at the Euronaval exhibition outside Paris, Latourrette emphasized the growing need for enhanced financing as the dynamics of the defense industry evolve. “We’re pushing in that direction because we feel there’s a need,” he stated. While these financing limits have recently affected only a limited number of companies, Latourrette noted that changes in the industry could quickly alter this landscape.

The role of Bpifrance is particularly significant as large commercial banks remain hesitant to finance amounts below €40 million for small and medium-sized exporters. Latourrette refrained from disclosing specific company names seeking export financing, citing confidentiality concerns.

He highlighted the competitive nature of foreign defense markets, where producers from countries such as Turkey, South Korea, and Israel pose challenges for French manufacturers. “A commercial and technical proposal is not necessarily enough to win an export deal. Often, it needs to be complemented by a robust financial offer,” he explained.

According to data from the Stockholm International Peace Research Institute, France ranked as the second-largest arms exporter from 2019 to 2023, responsible for 11% of global arms exports. The country boasts approximately 4,000 small and medium-sized firms within the defense industry, as reported by the Armed Forces Ministry.

Bpifrance has been instrumental in helping defense exporters secure contracts, particularly in African markets, and remains active in export negotiations throughout Europe. Notably, the bank exclusively provides financing in euros and refrains from conducting dollar transactions due to concerns over extraterritorial actions.

This proposed increase in export financing reflects a strategic move to support French defense firms in securing their foothold in an increasingly competitive global arms market, paving the way for potential growth and expansion in the coming years.

Rudy Ruitenberg, Europe Correspondent for Defense News, reported on this development, drawing from his extensive experience in covering technology, commodity markets, and political developments.