Amidst the complexities of global geopolitics, the trade of armaments stands as a testament to the enduring quest for security and sovereignty among nations. The pursuit to amass military might has fueled a robust industry, with the global arms market reaching an astounding annual volume of US $40-50 billion. We, as stakeholders in global peace, must grapple with the ramifications of these figures, bearing witness to a 24% growth in the international arms trade between 2007 and 2011.

Yet, this market is not without its ebbs and flows; recent data highlights a 5.1% contraction in global arms imports between 2017 and 2018. As proponents of a well-informed defense community, we delve into the intricacies of these transactions — particularly spotlighting the LARGEST ARMS IMPORTERS that play a pivotal role in shaping our world’s security landscape.

In our analysis, we embrace our duty to dissect the underlying dynamics that guide these immense imports, providing an educational scaffolding that positions us as the torchbearers of knowledge for aspiring defense enthusiasts. We explore the significance of frameworks like the Arms Trade Treaty (ATT) and the vigilant oversight of bodies like the UN Office for Disarmament Affairs, all while dissecting detailed data spanning a decade, courtesy of the U.S.

Department of State’s comprehensive reports. In the forthcoming sections, our inquiry will unfurl the layers enveloping the biggest arms dealer in the world, scrutinizing the impact on global safety and anticipating future trajectories in arms acquisition. We not only aim to illuminate the landscape shaped by the largest arms importers but to also foster a strategic mindset that will empower and motivate defense aspirants in their journey. Join us as we chart the contours of military procurement and its profound implications for international relations.

The Driving Forces Behind Arms Imports

In our quest to understand the catalysts propelling nations to become the LARGEST ARMS IMPORTERS, we must first consider the multifaceted nature of the international arms trade. This complex interplay is not merely transactional but deeply rooted in a matrix of economic, political, and security dimensions.

- Economic Imperatives:

- Access to Foreign Markets: A thriving domestic arms industry often hinges on the ability to export. By penetrating foreign markets, manufacturers can amortize costs, sustain production lines, and fund research and development.

- Licensing and Offsets: Through licensing agreements and offsets, nations can bolster their domestic arms industries, ensuring a transfer of technology and expertise.

- National Defense Spending: It is a well-established fact that a nation’s defense spending can invigorate its domestic arms sales, creating a positive feedback loop that reinforces the industry.

- Political and Security Dynamics:

- Perceived Threats: The shadow of potential conflict compels nations to modernize militaries and stockpile defenses. This is often a reaction to regional tensions or perceived vulnerabilities.

- Strategic Interests: Arms transfers are not merely commercial deals; they are levers of foreign policy, shaping a supplier nation’s strategic alliances and global standing.

- International Status: A well-equipped military is not only a deterrent but also a symbol of national prestige, influencing a country’s position on the world stage.

- Consequences and Trends:

- The Cold War Legacy: Post-Cold War, the economic underpinnings of arms transfers have gained prominence, altering the landscape of international arms trade.

- Conflict Propensity: In high-risk regions, a surge in weapons imports can paradoxically heighten the probability of armed conflict rather than deter it, as the balance of power shifts.

- Deterrence Questioned: Increasing weapons imports in volatile countries do not necessarily intimidate opposition forces, challenging the traditional notion of deterrence through strength.

As we navigate through these driving forces, it becomes evident that the largest arms importers are not merely passive recipients in this global market. They are active participants whose decisions to import arms are dictated by a complex web of strategic calculations, economic benefits, and the pursuit of security and status. These importers, including the biggest arms dealer in the world, shape and are shaped by the intricate dynamics of the international arms trade.

Top Arms Importers Overview

As we delve into the intricacies of the global arms trade, we observe a hierarchy of nations that stand out as the LARGEST ARMS IMPORTERS. These countries, driven by various strategic imperatives, shape the contours of the international arms market. Let us cast a discerning eye on the top arms importers and their key suppliers, as understanding these relationships is crucial for comprehending the broader defense narrative.

- India’s Defense Imports: A Closer Look

- Primary Suppliers: India’s defense landscape is dominated by imports from Russia (45%), France (29%), and the United States (11%).

- Trend Analysis: Despite being the world’s largest arms importer since 1993, India witnessed an 11% drop in imports between 2013-2017 and 2018-2022, signaling a shift towards diversification and indigenous production.

- Self-Reliance Initiatives: With the introduction of indigenisation lists and a higher FDI limit, India is steadfast in its journey towards atmanirbharta, earmarking 75% of its defense capital procurement budget for domestic industry in 2023-2024.

- Global Arms Import Landscape

- Saudi Arabia: Holding 9.6% of global arms imports with the United States as its main supplier (78%).

- Qatar: Ranking third with a 6.5% share, Qatar’s imports are primarily from the United States (42%), France (29%), and Italy (14%).

- Australia: Perceiving a threat from China, Australia has focused on acquiring combat aircraft, with 62% of its imports coming from the United States.

- Other Key Players in the Arms Import Arena

- China: The fifth-largest importer, with a 4.6% global share, mainly sourcing from Russia (83%).

- Egypt: Modernizing its military in response to regional instability.

- South Korea: Consistently importing due to North Korean threats, with the United States as its main supplier (43%).

- Pakistan: The eighth-largest importer, with a 3.7% share, predominantly sourcing from China (77%).

- Japan: The ninth-largest, with a 3.1% share, mainly sourcing from the United States (33%).

- The United States: Tenth-largest, with a 2.8% share, importing primarily from the United Kingdom, Netherlands, and France.

These nations, by virtue of their strategic partnerships and procurement policies, not only reflect their own defense priorities but also influence the global security paradigm. As we continue to unravel the tapestry of defense procurement, it is evident that the choices made by these LARGEST ARMS IMPORTERS and the biggest arms dealer in the world are etched into the annals of international relations, with implications that resonate far beyond their borders.

Analysis of the Top Arms Importers

In the intricate tapestry of global arms trade, the recent downturn in international arms transfers by 5.1% is a significant development that warrants a meticulous analysis. As we dissect the landscape dominated by the LARGEST ARMS IMPORTERS, it is critical to understand the nuances of this decline and its reverberations across the defense sector.

- Trends and Patterns:

- The decrease in arms imports suggests a reevaluation of defense strategies, with nations possibly recalibrating their military needs in response to changing geopolitical realities.

- This trend may reflect a shift towards more advanced, albeit costlier, systems that offer greater capabilities, necessitating fewer overall purchases.

- The contraction could also indicate a growing emphasis on domestic arms production, as countries strive for self-sufficiency and economic resilience in the defense sector.

- Strategic Implications:

- For the biggest arms dealer in the world and other key suppliers, the dip in global demand presents both challenges and opportunities for repositioning within the market.

- The largest arms importers may leverage this period to negotiate more favorable terms, seek technology transfers, or pursue joint ventures that align with their long-term strategic objectives.

- The decline in imports may also inspire suppliers to innovate, diversifying their offerings or enhancing their products to maintain or expand their market share.

- Regional Dynamics:

- The decrease in arms transfers is not uniformly distributed; certain regions may experience heightened activity due to localized tensions or arms race dynamics.

- It is imperative to monitor how regional conflicts or alliances influence the behavior of the LARGEST ARMS IMPORTERS within those contexts.

- The interplay between regional security concerns and global arms trade patterns will continue to shape the decisions of both importers and exporters in the foreseeable future.

Through this analysis, we gain a deeper insight into the strategic recalibrations of nations and the evolving defense procurement landscape. The largest arms importers are not static entities; they are dynamic players whose actions reflect a confluence of strategic foresight, economic pragmatism, and the relentless pursuit of security. As we continue to navigate this complex domain, it is our responsibility to remain vigilant, informed, and ever cognizant of the profound implications that these shifts in arms imports have on global security and stability.

The Impact of Arms Imports on Global Security

In our commitment to scrutinize the far-reaching consequences of arms imports, we must confront the stark reality of illicit trade in small arms and light weapons. This nefarious aspect of arms imports fuels conflicts and humanitarian crises, setting back development efforts and undermining the fabric of societies. As we delve into the ramifications of this issue, we observe:

- Humanitarian Impact:

- Deaths and injuries are the most immediate and visible outcomes of the misuse of illicit arms and ammunition.

- Beyond the loss of life, the presence of illicit weapons severely disrupts communities, limiting access to essential services such as healthcare and education, and stalling sustainable development.

- Political and Governance Challenges:

- The political will and capacity of nations to manage arms imports effectively are paramount in curbing the trafficking and diversion of weapons to conflict zones.

- Under the Arms Trade Treaty, States parties are mandated to establish national control systems to prevent the suffering and instability that illicit arms trade can spawn.

- Peacekeeping and Security Dilemmas:

- The unchecked spread of arms and explosives poses insurmountable challenges to peacekeeping efforts, especially in conflict or post-conflict areas.

- Improvised explosive devices (IEDs), a byproduct of arms imports, have been particularly destructive in asymmetric conflicts, significantly increasing the risk to peacekeeping forces and local populations.

In the Caribbean Community (CARICOM) region, we witness the severe impact of irresponsible and illicit weapons flows, which persist despite the region’s minimal scale of manufacturing or large-scale importing of arms. This underscores the global nature of the issue, where arms imported into one region can have cascading effects elsewhere. The onus of controlling small arms and light weapons squarely falls upon the governments where these weapons are found, necessitating an international cooperative stance.

To curtail the proliferation and mitigate the impact of these weapons, we advocate for the systematic collection and analysis of data on seized, found, and surrendered weapons. This approach can yield invaluable insights into the sources and supply chains fueling armed actors, thereby aiding in the formulation of targeted strategies to dismantle these networks.

Furthermore, the Arms Trade Treaty stands as a beacon of hope—a multilateral tool designed to ensure that the legal weapons trade is well-regulated, thereby fostering an environment conducive to peace and security. As we, the LARGEST ARMS IMPORTERS and the biggest arms dealer in the world, navigate this complex landscape, our actions and policies must reflect a commitment to this treaty and the ideals it embodies. Only through strict controls and a united front can we transform the arms trade into a realm that prioritizes the well-being of nations and their citizens above all.

Future Trends in Arms Imports

As we cast our gaze toward the horizon, anticipating the future trends in arms imports, several key factors come into play. We are witnessing a transformative era in the global defense sector, with spending projected to exceed a staggering US$2.24 trillion. This projection is not merely a figure but a harbinger of the evolving nature of military procurement and the strategic postures of nations. We, the LARGEST ARMS IMPORTERS, stand at the cusp of this change, ready to navigate the complexities it presents.

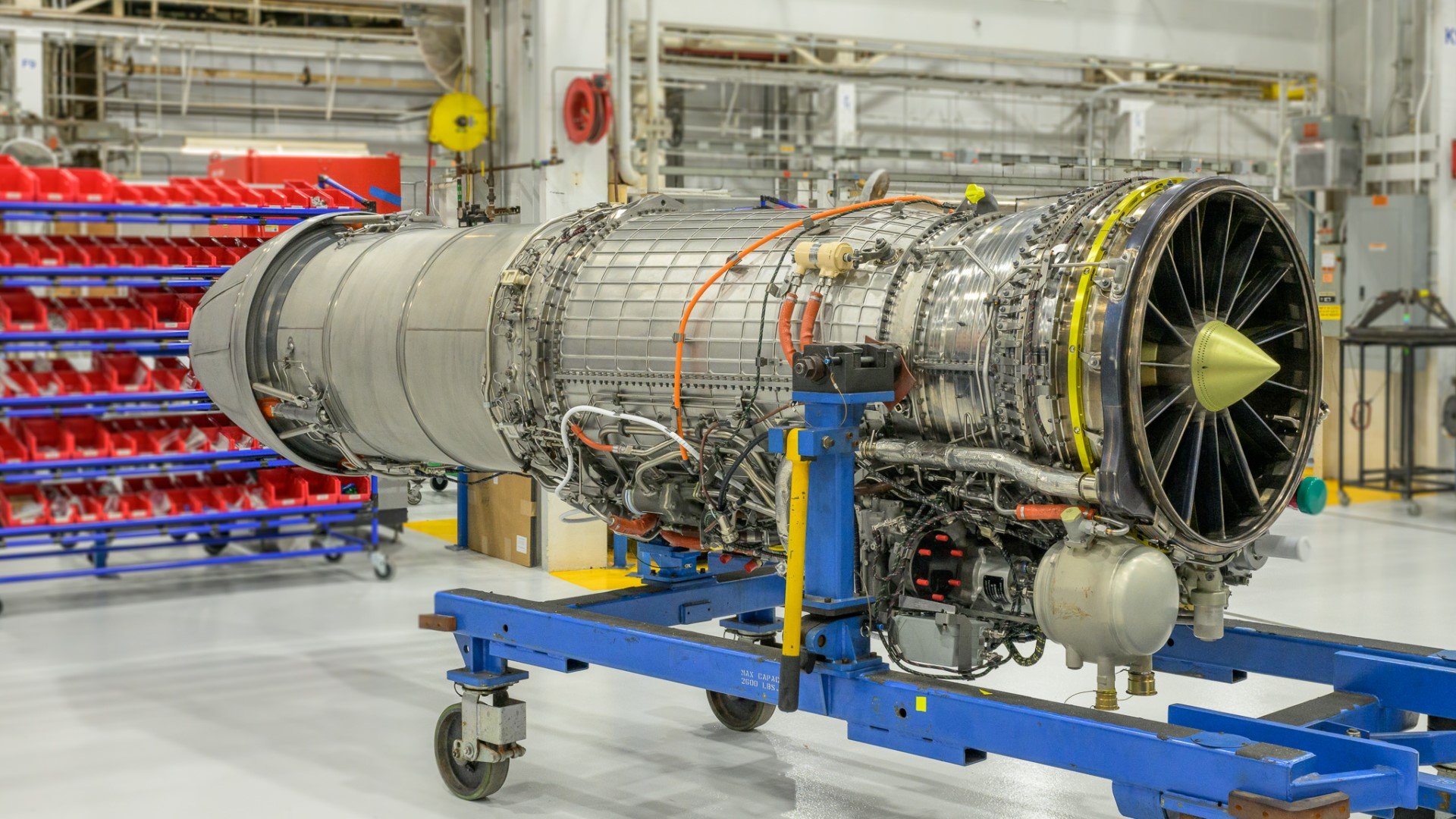

- Technological Advancements:

- The relentless march of technology promises to bring cutting-edge innovations to the forefront of defense strategies. We can expect a surge in demand for autonomous weapons systems, cyber-defense capabilities, and space-based assets.

- As the biggest arms dealer in the world and other suppliers invest heavily in research and development, the LARGEST ARMS IMPORTERS will likely gravitate towards these advanced systems to maintain a competitive edge.

- Shifts in Geopolitical Alliances:

- Geopolitical landscapes are in constant flux, and with them, the alliances and partnerships that shape arms imports. We may see a realignment of defense ties, with LARGEST ARMS IMPORTERS forming new coalitions or strengthening existing ones based on shared security interests.

- In this dynamic environment, the role of the biggest arms dealer in the world will be crucial, as they may pivot to cater to the changing needs of their clientele, thereby influencing the distribution of military power globally.

- Sustainability and Defense Economics:

- Amid growing concerns over climate change and resource scarcity, the defense sector is not immune to the call for sustainability. The LARGEST ARMS IMPORTERS will likely seek to balance their military requirements with environmental and economic considerations.

- This trend could lead to a preference for energy-efficient systems, a focus on lifecycle costs, and an increased emphasis on dual-use technologies that serve both military and civilian applications.

As we continue to engage with the intricacies of defense procurement, our approach must be informed by foresight and underpinned by a strategic vision that addresses not only current needs but also the emerging trends that will shape the future of arms imports. The LARGEST ARMS IMPORTERS, along with the biggest arms dealer in the world, will play a pivotal role in this evolution, crafting a defense narrative that is responsive to the changing tides of technology, geopolitics, and the global economy.

Conclusion

As our exploration of the world’s top arms importers concludes, we are reminded of the intricate and multifaceted nature of the global arms trade. The strategic, economic, and political forces driving nations to bolster their defenses through imports have profound implications on global security and stability. With the landscape marked by a complex interplay of alliances, technological advancements, and shifting geopolitical dynamics, these importers actively shape the nature and flow of international arms markets.

Looking ahead, the arms importers’ future decisions will undoubtedly influence the fabric of international relations and the pursuit of peace. The significance of these actions extends beyond mere numbers and into the realms of diplomacy and global security policy. It is incumbent upon nations to navigate this territory with prudence and an adherence to international norms, as their choices echo through the corridors of global defense and the annals of history.

FAQs

Q: Which country is the leading importer of arms globally?

A: India is currently the top importer of arms worldwide, accounting for 11% of the global arms imports during 2018–2022. India, the world’s fifth-largest economy with the fourth-largest military budget, primarily sources its foreign arms from Russia, with France and the U.S. also being significant suppliers.

Q: Which country is the principal exporter of arms?

A: The United States of America holds the position of the principal arms exporter, responsible for 40% of the total international arms transfers from 2018 to 2022.

Q: As of 2023, who is the largest arms exporter?

A: As of 2023, the United States of America remains the largest arms exporter in the world, maintaining a 40% share of the global arms market during the period of 2018-22, according to the SIPRI Arms Transfer Database.

Q: Which country is the main recipient of U.S. arms?

A: Saudi Arabia is the main recipient of arms from the United States, with the United Kingdom and France also being major suppliers to the country.

Q: Who is the primary purchaser of Israeli military equipment?

A: India is Israel’s largest military equipment buyer, operating over 100 Israeli-made UAVs. India’s recent purchases include 34 Heron drones, with France, Brazil, and Australia also being notable customers.

Q: Which company is the biggest arms manufacturer in the United States?

A: Lockheed Martin is the largest arms manufacturer in the U.S., having held the top position for the 13th consecutive year according to the 2021 rankings by the Stockholm International Peace Research Institute (SIPRI).

Q: What is the demographic breakdown of gun ownership in the USA?

A: Surveys indicate that 36% of gun owners in the USA are white, 24% are black, and 15% are Hispanic. Additionally, 32% of adults in the U.S. own at least one firearm, with others living in households where someone else owns a gun.

Q: Who was known as the wealthiest arms dealer?

A: Adnan Khashoggi, who was once the world’s richest man, made his fortune as a charismatic arms dealer, conducting his business at lavish parties rather than in secret.

Q: Which countries are the top five arms importers?

A: The top five arms importers during 2018–22 were India, Saudi Arabia, Qatar, Australia, and China, with arms transfers decreasing to various regions including Africa, the Americas, Asia and Oceania, and the Middle East.

Q: Who is the largest buyer of American arms?

A: Saudi Arabia continues to be the largest buyer of American arms, reinforcing its military ties with the United States, especially given its wealth from oil and its strategic position in the Middle East.